30+ percentage of income mortgage

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the 28 rule which states that no more than 28 of your gross monthly income should be spent on housing costs. Check How Much Home Loan You Can Afford.

San Francisco Bay Area Housing Affordability Home Team Paragon Real Estate

Select Apply In Minutes.

. Explore Quotes from Top Lenders All in One Place. Looking For Conventional Home Loan. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term.

This meets the Department of Housing and Urban Developments definition of being cost. Ad 5 Best Home Loan Lenders Compared Reviewed. Web A 15-year term.

At 6 fixed interest that amount rises to 1986. Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income which is your total income before. Compare Lenders And Find Out Which One Suits You Best.

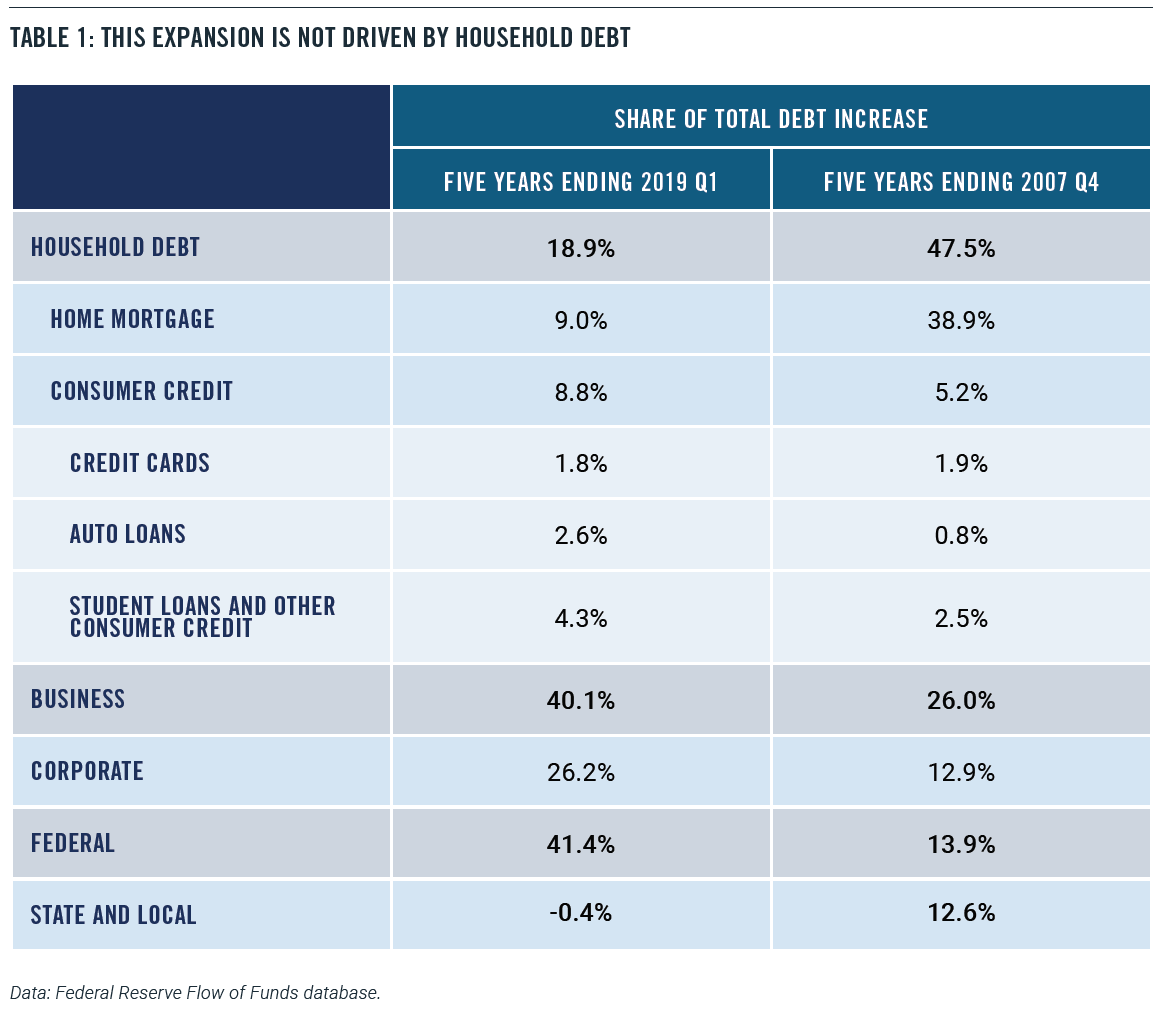

DTI this is your total monthly debt payments divided by your gross monthly income before tax written as a percentage. Web A mortgage of 300000 will cost you 1620 per month in interest and principal for a 30-year loan and a fixed 4 interest rate. Web What Percentage of Your Income Can You Afford for Mortgage Payments.

Explore Top Rated Information. This 28 is often referred to as a safe mortgage-to-income ratio or a good general guideline for mortgage payments. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Distinguishing between needs and wants isnt always easy and can vary from one budget to another. Ad 30 Year Mortgage Rates Compared.

Comparisons Trusted by 55000000. For example if you make 10000 every month multiply 10000 by 028 to get. Special Offers Just a Click Away.

Pre-tax income goes toward your mortgage payment both principal and interest property taxes and mortgage insurance. For example if youre buying a 250000 home with a 4 interest rate. Generally though wants are the extras that arent essential to.

Web As a general rule you want to spend no more than 30 percent of your monthly gross income on housing. In 2020 46 of American renters spent 30 or more of their income on housing including 23 who spent at least 50 of their income this way according to the most recent data available from the US. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property taxes and insurance.

Mortgage lenders want their borrowers to be able to keep this below 28. If youre a renter that 30 percent includes utilities and if youre an owner it. Compare Offers Side by Side with LendingTree.

Web Renters are feeling the strain. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Predict Your Mortgage Payments So You Can Be Sure It Fits Your Budget.

To determine how much you can afford using this rule multiply your monthly gross income by 28. Ad Calculate Your Payment with 0 Down. 2022s Top Mortgage Lenders.

Looking For Conventional Home Loan. Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage. Compare Now Save.

Web A mortgage payment on an average-price home with a standard 20 down payment 30-year mortgage now adds up to 31 of the median American households income according to new data from Black. Ad Compare Loans Calculate Payments - All Online. For example if your monthly income is 5000 you can afford up to 1400 per month on your mortgage.

Web To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income. Web 30 of your income. Your DTI is one way lenders measure your ability to manage monthly payments and repay the money you plan to borrow.

Comparisons Trusted by 55000000. Get Instantly Matched with Your Ideal 30 Year Mortgage Lender. Saving tens of thousands in interest.

Begin Your Loan Search Right Here. Ad 5 Best Home Loan Lenders Compared Reviewed. Compare Lenders And Find Out Which One Suits You Best.

Choose Smart Apply Easily. Ad Compare the Best Mortgage Lender To Finance You New Home. 1400 5000 028 which converts to 28 The 36 rule applies to the back-end ratio or your DTI ratio.

Ad Get the Right Housing Loan for Your Needs. The most common term for a mortgage is 30 years or 360 months but different terms are available depending on the.

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Percentage Of Income For Mortgage Payments Quicken Loans

Omer Alvie On Linkedin This Is The Highest Mortgage Cost As A Percentage Of Household Income In

Wellsfargo3q20quarterlys

Low Income Borrowers And The Auto Loan Market Aaf

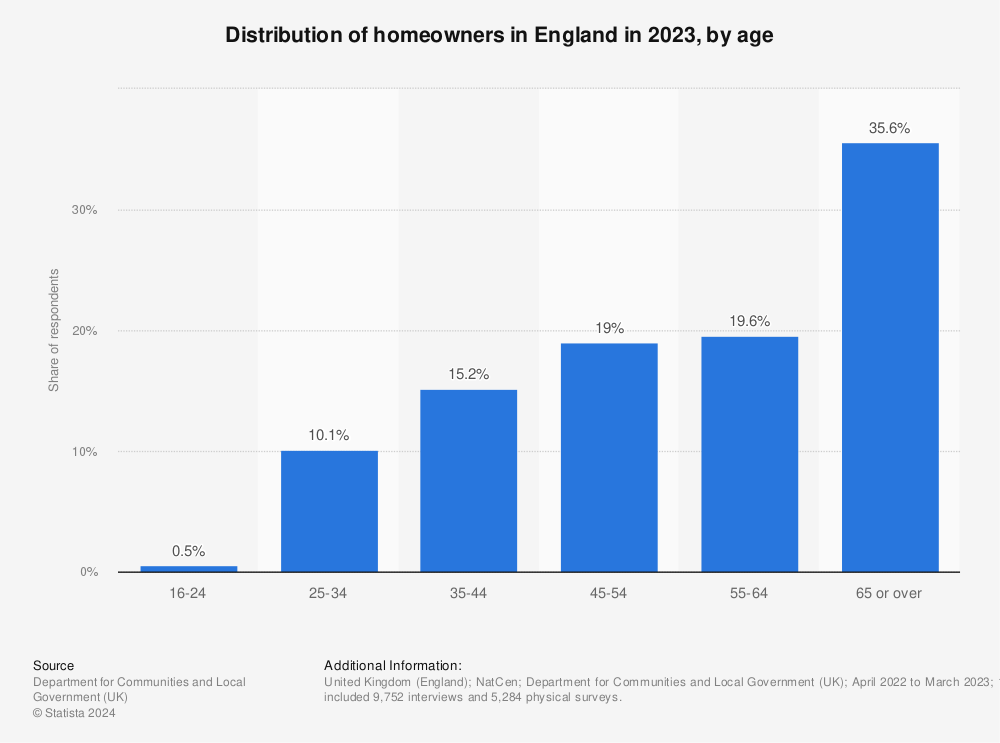

England Age Distribution Of Home Owners 2021 Statista

15 Vs 30 Year Mortgage Which Is The Best Choice White Coat Investor

What Percentage Of Income Should Go To Mortgage Banks Com

What Is The Monthly Repayment On A 800000 00 Mortgage With 250000 00 Deposit Quora

How Debt And Income Affects Mortgage Affordability Homewise

Mortgage Lender Woes Wolf Street

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

Mortgage Lender Woes Wolf Street

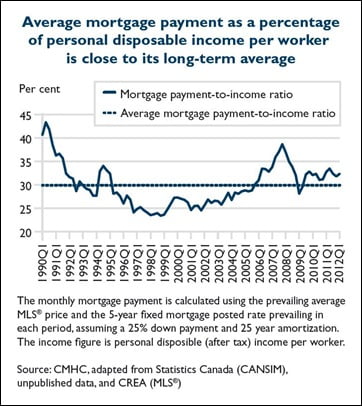

Facts From The 2012 Canadian Housing Observer Mortgage Rates Mortgage Broker News In Canada

Blog Department Of Numbers

Do The Numbers Make Sense To Build An Adu In Denver Denver Investment Real Estate